PICOR Thoughts From the Multi-Market Family

PICOR’s Thoughts

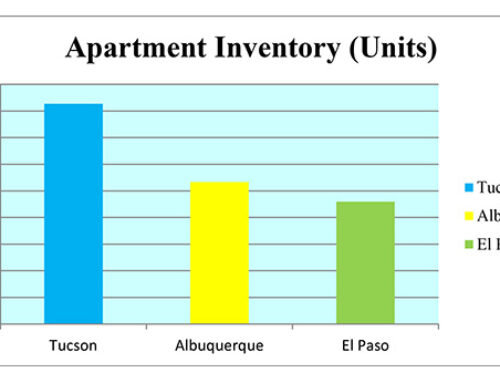

“What a wild and crazy 1st half of 2022 the multi-family market encountered! We have change in in-bound phone calls coming through as many owners are curious what the higher interest rates will mean for values going forward. We should see a pickup of inventory towards the end of this year as the “new market” begins to be established which likely includes cap rate adjustments. The value-add market should remain deep and strong as many investors are banking on continued rental growth in Tucson. The local market is primed to withstand any major dip due to the extreme lack of rental inventory (years and years behind in supply). Tucson is in a great position short and long term!”

Allan Mendelsberg – PICOR Commercial Real Estate – amendelsberg@picor.com – 520-546-2721

“For the second half of 2022, I expect the Tucson market to remain relatively strong. We have relatively high cap-rates and lower price per unit cost than similar 1mm+ population markets. The adjustment in the market will be purchasers being more conservative with their underwriting as rental growth will likely slow (understandably as Tucson has seen unrealistic rent growth over the past three year) and interest rates will continue to rise. Properties taken to the market six months ago would have received 10+ offers, now they are receiving 2-5 offers.”

Conrad Joey Martinez – PICOR Commercial Real Estate – cmartinez@picor.com – 520-546-2730

Lender’s Thoughts

“We’ve seen the treasury yields increase across the board and we are expecting interest rates to continue to rise. The rise in the treasury will have a direct impact on our pricing, however property values remain stable as there is strong demand for multifamily. While our program limits LTV to 70 percent in most cases, we are originating purchases around the 60-65%. We are anticipating moderate origination, with a mix of refi and purchases 50/50. I am anticipating an increase of refinances as short-term purchase debt form past couple years comes to maturity.”

Robert Motz – Pima Federal Credit Union – rmotz@pimafederal.org – 520-202-0672

Appraiser’s Thoughts

“Currently, the Tucson apartment market is strong with rents at all-time highs and vacancy still at low levels, reported at 5.77% according to Q2 2022 Apartment Insights. However, we do see some headwinds, including interest rates climbing quickly, which will put upward pressure on capitalization rates. The rents have been rising quickly, but appears to be peaking, as rental rates are stabilizing or dropping in larger markets. Inventory is still low, but there are many projects coming online. Going forward, I believe we will see rents stabilize and possibly decline, vacancy rates staying stable or possibly increasing, cap rates rising along with interest rates, and fewer proposed projects. We have not seen nominal changes in cap rates so far but have seen a slight increase in vacancy rates and eviction notices, which we are accounting for in appraisals.”

Ajay Madhvani – AM Valuation Services – ajaym1999@gmail.com – 520-441-9030

Manager’s Thoughts

“Our predictions for the rental market in the balance of 2022 are positive: We expect rents to continue to increase, albeit potentially at a slower rate than we have been experiencing and will at worst remain steady. While rental activity for some unit types have slowed, we do continue to see an extremely strong rental market, with the brand new, fully remodeled units still moving as quickly as they come on the market. The subsidy/low income market is struggling as there is extremely limited inventory that meets within the current Fair Market Rate (FMR). Tucson will need to address what to do with our current population struggling with these high rents, though they are still significantly below other similar markets.”

Michelle Cunningham – Fort Lowell Realty – michelle@flraz.com – 520-308-8198

“Rent growth will slow in the 2nd half of 2022 due to the rising fuel costs and inflation. Tucson continues to be an excellent market for value-add investors as many properties were built in the 1980s and 1990s, with construction stagnating in the 2000s except for Student and Luxury. The largest opportunity exists in minor value add targeted towards work force. As the work force housing is betting gobbled up by value-add investors looking to become B+ assets, many residents are finding themselves being priced out of their homes. Tucson has always been a moderately priced alternative to Phoenix and as the economy changes my hope would be to see investors re-embrace the idea of well-maintained work force housing.”

Ann Diaz – AZ First Realty & Management – anndiaz@azfirst.com – 520-906-0219